6 Simple Things That Every Singaporean Can Do To Move Up The Social Ladder

Not too long ago, socioeconomic status (SES) was all the rage among Singaporeans, all thanks to a Social Studies textbook. Thereafter, the debate of social mobility in Singapore started. We even had our DPM Tharman coming out to talk about his famous ‘escalator of social mobility’.

While social mobility is an issue that should be tackled by the government, there are actually some simple things that individuals like you and I can do to help ourselves move up the social ladder. Ready to take things into your own hands to propel your SES?

-

Take Charge Of Your Career

In order to move up the social escalator, your earning power will be a key contributing factor that determines your success. Your earning power is highly correlated to how far you can go in your career. Thus, the first step to take to move up the social escalator is to take charge of your career. So, what does it mean to take charge of your career?

For starters, make sure you have a long term goal of how you want to develop your career. If you are an accountant, you might be aiming to become a financial controller by age 40. Next, with the goal in mind, spend time and effort to develop yourself, both in terms of skills and mentally. Seeking good mentors and embracing networking are also important when it comes to taking charge of your career. Excelling in one, or both, can greatly improve your chances of boosting your career prospects.

One may also consider taking the leap to work as an insurance advisor or property agent. The top 15% of these group of profession normally earns 6 figure income per year, so if you have a gibberish tongue, a good network and have passion in properties or giving financial advise, the world is your oyster!

With a better career comes with greater influence and earning that will help you move up the social escalator. That being said, there are other factors that are as important, if not more important, than your earning power.

-

Keep Track Of Your Spending

Robert Kiyosaki, author of ‘Rich Dad, Poor Dad’ has this famous quote: “It is not about how much money you make, but how much money you keep, how hard it works for you and how many generations you keep it for”. Notice how he gave priority to saving in the first part of his quote? Indeed, saving is one of the key steps to take care of if you want to move up the social escalator into ‘high SES’.

To be able to save effectively, you need to ensure that you keep track of your spending. This allows you to identify areas of spending where you can then minimize and accumulate more dollars to save. If you are looking for a good app to keep track of your spending, try Seedly. It has a simple user interface and the functionality to link with your local bank accounts. You don’t even have to key in your expenses one by one!

-

Set Financial Goals

A common source of failure for most people when trying to move up the social escalator is to lose sight of the goal. You might start off with a bang but you soon falter as you grow tired and disillusioned about your chances of attaining a higher SES. To avoid such tragedy from happening, you need to keep yourself focused and on track. Setting financial goals along the way towards your target SES is a simple way to do that.

As you start the new year, one simple financial goal to start with is to aim to increase your saving amount by 20%. You might even want to increase it by 40% if you are more ambitious. Another financial goal you can aim for is to reduce your debt by 10%, apart from your usual debt repayment. By creating small money milestones for yourself, it helps you stay focused and on track for your ultimate goal of achieving better SES.

-

Finding Out What Kind Of Insurance You Need

Often, most people only think about how high they can go in achieving higher SES. Yet, we often neglect the fact that what goes up must come down. There will bound to be ups and downs in life. For example, as you hit the peak of your career, you might (touchwood) be diagnosed with a major illness. Sounds pretty Korean drama, but these things do happen in reality. Thus, it is important that you cover your downside risks with the right kind of insurance.

As an individual, health insurance and critical illness plans are crucial. If you have dependents (e.g. kids, parents), life insurance will also be vital to ensure that your downside risks are well protected. You don’t want to be left rueing when you are struck with a misfortune. Without the right insurance, you will be poorer, both financially and mentally.

Read: How much should I spend on insurance per month?

-

Do It Like The Rich: Invest

Still remember the Robert Kiyosaki quote in the first part of this article? Apart from highlighting the importance of saving, Robert Kiyosaki also pointed out that you need to make your money work hard for you. According to Robert Kiyosaki, the reason why the rich continues to become richer by the day is because they let their money work hard for them.

The fact is that each of us only have 24 hours a day. Even if you choose to sleep only 6 hours a day, you will have a maximum of 18 hours in a day. There is still a limit to how much money you can make by relying on the hours that you clock in. Investing, on the other hand, doesn’t depend on how many hours you clock in. With investing, you can still earn money while you are asleep. There is also no need to constantly monitor your investment for it to grow. If you are determined in moving up the social escalator, make sure you get started with investing today.

Lost about where to start your investing? How do you even start investing? If these are questions that you are pondering about, Moneyline is here to provide sound financial advice for you. Engage with one of our trusted financial advisors to understand more about investing and how different types of investing can help you achieve higher SES.

-

Plan For Retirement

In our parents’ generation, some of them had to deal with their family’s financial constraints. As such, it was hard for our parents to move up the social escalator, especially when they have dependents to take care of (i.e. our grandparents). While the financial constraint problems are less prominent, our children are facing another challenge on their own.

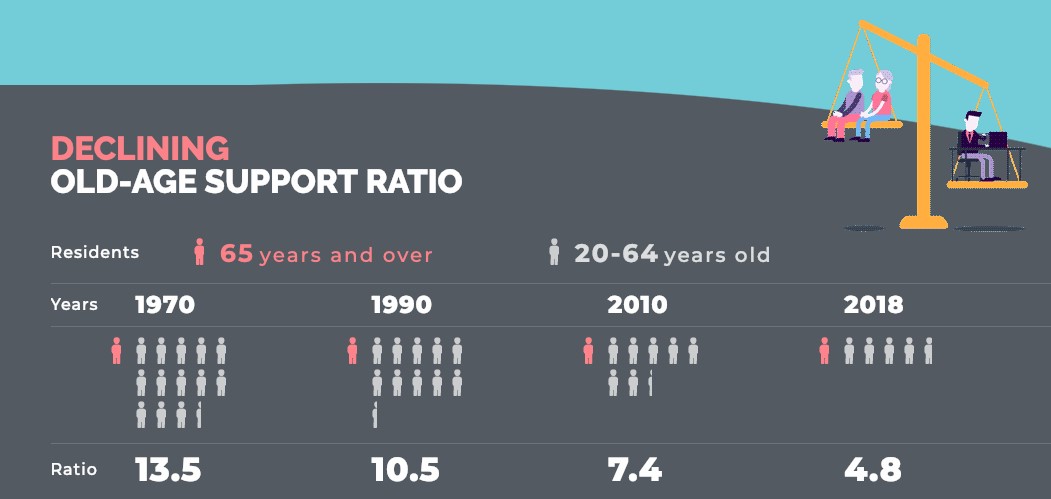

With the low birth rate, Singaporean children are faced with greater responsibility on their shoulders of taking care of us when we grow old. According to SingStat, Singapore’s old age support ratio is now 4.8. This means that ~5 adults have to support every one elderly. This creates more financial and emotional burden on our children.

Source: SingStat.gov.sg

Rather than rely on our children to take care of us, why not we take care of our own needs? By planning for retirement early, we can relieve them of the financial pressure. At the same time, it also allows them to work towards moving up the social escalator for themselves.

Read: 3 Best Retirement Plans in Singapore