Compare and Understand the Best Maternity Insurance in Singapore

Maternity insurance offered by Insurers are anything but simple, there are generally two types of maternity insurance plans. Bundled Maternity insurance is where it is compulsory to pair up with a life insurance product and a Stand-Alone Maternity insurance where there is no requirement to pair up with another life insurance product. In this article, we explore and compare 5 major insurance company plans to understand the pros and cons of getting them.

This article is for general information only it is not an advise nor does it take into account the specific investment objectives, financial situation or needs of any particular person. Read our General Disclaimer

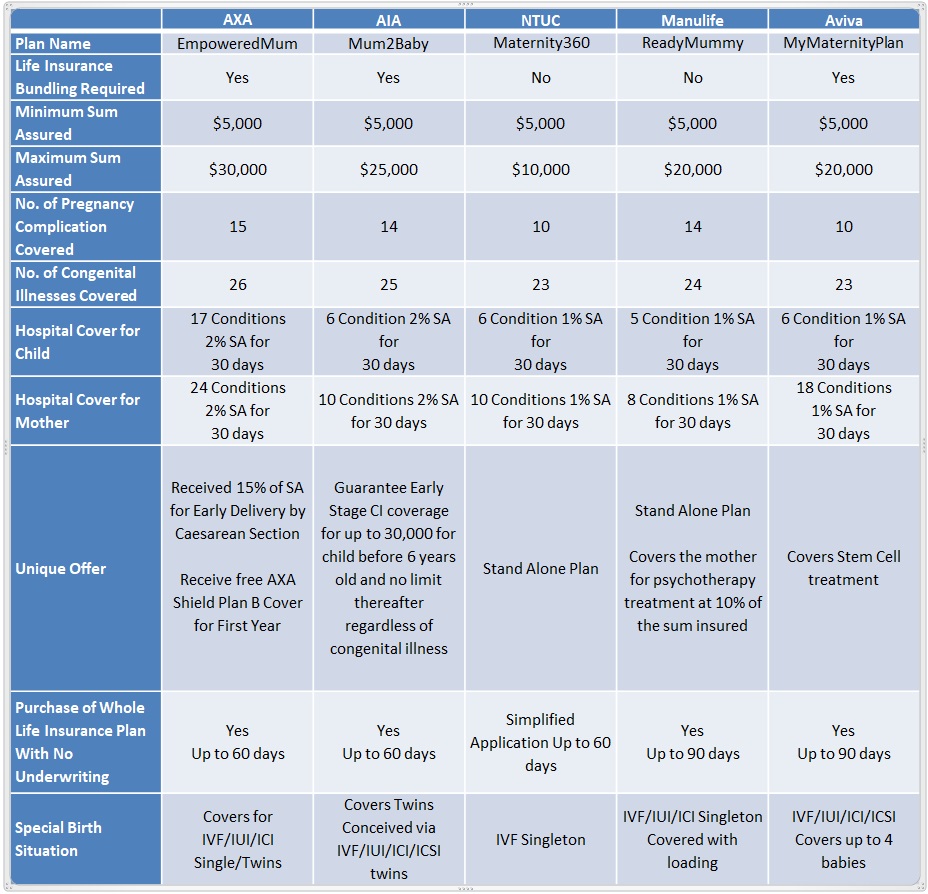

Here is the Summary of Important Features of Each Insurers

source: Aviva, AIA, Manulife, NTUC, AXA

Best Maternity Insurance for Pre-Existing Critical illness Coverage

AIA Mum2Baby

Supplement your child’s protection with guaranteed multistage critical illness coverage right from the start without underwriting.

Before age 6, the child is able to claim up to 30,000 for pre-existing CI. After age 6, the child is able to claim up to maximum sum assured.

Eligible Age: 16 – 45 years old

Pregnancy Eligibility: 13 – 36 weeks

Bundled Products: AIA Guaranteed Protect Plus II & AIA Prolifetime Protector II

Best Maternity Insurance for Premature Caesarean and Free Shield Cover

AXA EmpoweredMum

Mothers receive 15% of the sum assured for a caesarean delivery at less than 36 weeks of gestation that is deemed necessary by gynaecologist.

First year premiums of AXA Shield Plan B coverage are complimentary.

Eligible Age: 18 – 45 years old

Pregnancy Eligibility: 13 – 36 weeks

Bundled Products (Father or Mother): AXA Early Saver Plus, AXA Retire Happy Plus (II), AXA Life Treasure, AXA Retire Treasure (II), Savvy Saver, AXA Wealth Accelerate, Pulsar, AXA Flexi Protector, AXA Wealth Harvest, AXA Term Protector/ Term Protector Prime, AXA Super CritiCare

Best Maternity Insurance for No Frills Valued Coverage

NTUC Maternity 360

Unlike all other maternity plans in the market, the NTUC Maternity 360 has no requirement to take up a separate life policy and can be bought as a stand alone plan.

Eligible Age: 18 – 45 years old

Pregnancy Eligibility: 13 – 35 weeks

Bundled Products: Not Required

Best Maternity Insurance for No Frills & Mother Mental Wellness

Manulife Ready Mummy

Manulife Readymummy do not require the policy holder/insured to buy a separate life policy, it also provides mother with psychiatric care coverage for up to 10% of SA in the event the mother suffers from Major Depressive Disorder (MDD) or Generalised Anxiety Disorders (GAD).

Eligible Age: 18 – 45 years old

Pregnancy Eligibility: 13 – 36 weeks

Bundled Products: Not Required

Best Maternity Insurance for Stem Cell Treatment and Most Babies Covered

Singlife Maternity Care

Singlife will cover up to four babies in a single pregnancy. The benefits in the Child’s benefit table will apply to each baby as an insured child separately. If the claim is made on one child only, the benefit will continue to be available for the other children. Subject to underwriting, Singlife will accept pregnancies through IVF/IUI/ICI/ICSI.

Aviva will pay 50% of the sum assured if the insured child requires the stem cell transplant surgery and has started the process of injection or extraction of stem cells.

Eligible Age: 18 – 45 years old

Pregnancy Eligibility: 13 – 36 weeks

Bundled Products (Father or Mother): IdealIncome, My Early Critical Illness Plan II, My MultiPay Critical Illness Plan IV, MyAccidentGuard, MyCare, MyCare Plus, MyCoreCI Plan II, MyEasySaver, MyIncomePlus, MyLifeChoice, MyLifeIncome II, MyLifeSavingsPlan, MyLongTermCare, MyLongTermCare Plus, MyProtector–Decreasing, MyProtector–Term Plan II, MyRetirement, MyRetirementChoice II, MySavingsPlan, MyShield, MyWealthPlan, MyWholeLifePlan III

Maternity Insurance, Are they Necessary?

The chance of claiming for any of the insured events is slim and definitely less than 10%. Most claims on maternity insurance revolve around hospital care benefit such as neonatal phototherapy care due to jaundice or neonatal ICU admission due to minor birth complications. Example, it is common to claim for NICU stay/treatment for the baby (which can cost up to $3,000 per day for severe cases in a private hospital). In such a case, the daily hospital cash payout may elevate some cost for the parents. Major complications which may lead to the disability or death of the mother/baby are rare and the sum assured paid out provides a rather short term solution to a lifetime financial and emotional burden.

Another practical reason for getting the maternity insurance is that insurer tends to provide the option to purchase their whole life insurance without the need for underwriting, as such, the child may get insured for critical illness not related or in some case related to the congenital condition they were born with. Certain congenital illnesses once diagnose can bar the child to be insured for life if the parents do not buy any maternity insurance coverage. Hence, if you have half the intention to get your child insured for life regardless of whether they are born healthy or not, it may be a sound decision to buy a maternity insurance plan.

Talk to us about your pregnancy

Let us know your situation and a partnered licensed maternity insurance expert will contact you to advise you on the most suitable plan

Your enquiry will be directed to a third party MAS Licensed Financial Planner, Please read our Privacy Policy

1 Comment