Setting goals is the first step in achieving anything that you want. For many of us, retirement is a goal…

NTUC Income Gro Retire Ease (Formerly RevoRetire): 4 Features That Makes You Want To Get One Today For Your Retirement

Are you mentally and financially prepared to retire? If you are like most Singaporeans, chances are you will only be mentally prepared to retire. You are probably still miles away from being financially prepared to retire.

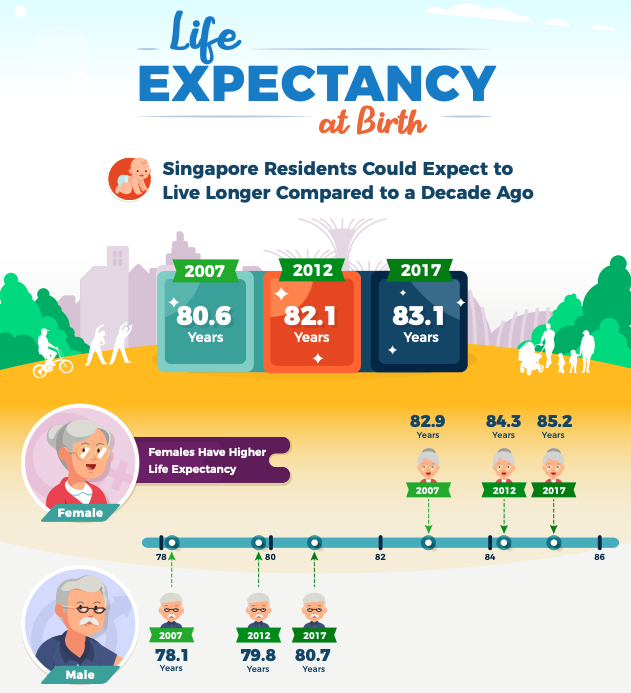

Source: SingStats

According to statistics released by SingStats, Singaporeans live till an old age of 80-85 years old on average. If you choose to retire by age 60 as stipulated by Singapore’s official retirement age, you will live in retirement for 23 years. But your CPF Life monthly payout only starts when you are age 65. There is (at least) a 5 years gap of income during your retirement that needs to be addressed, not to mention if Singaporeans can’t hit CPF’s minimum sum. This is one of the reasons why Income introduced its retirement plan RevoRetire.

Read: Review 3 best retirement plans in Singapore

What Is NTUC Income Gro Retire Ease And How Does It Work?

NTUC Income Gro Retire Ease is a flexible regular savings plan that is meant to help you save for your retirement so that you can receive monthly cash flows during your retirement.

How Does It Work?

With NTUC Income Gro Retire Ease, you start with the end goal in mind. You start by thinking about the retirement lifestyle/plan that you want at your desired retirement age. You can choose to start your retirement payout at any age from 50,55, 60 or 65 or start your payout after 10 or 15 years.

NTUC Income Gro Retire Ease Case Study – Mr Ong, Middle Class Aged 40

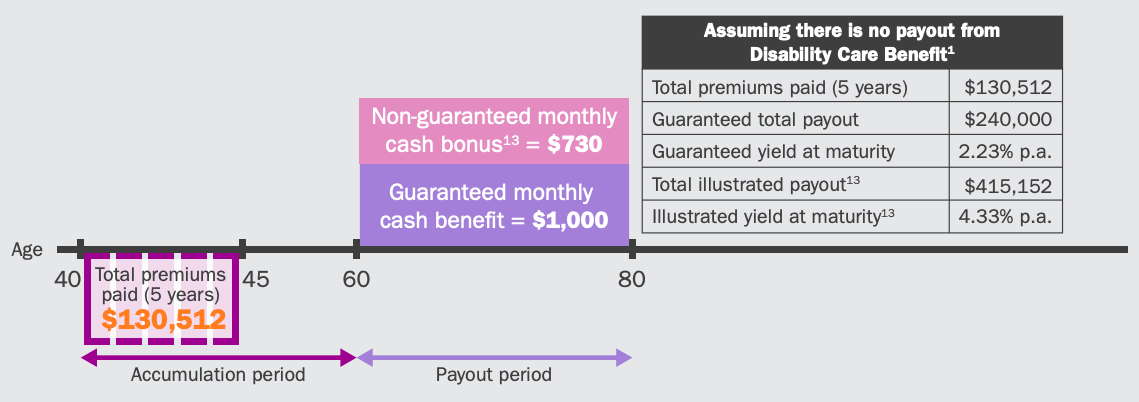

For example, Mr Ong wants to receive a monthly cash payout of $1,000 at age 60. He plans to use Gro Retire Ease as his retirement planning tool to help him supplement his retirement cash flow.

| Steps | Description | Case Study Scenario |

| Step 1: Choosing Premium Payment Term

|

Mr Ong will choose the number of years he wants to pay premiums for with choices ranging from 5, 10 or up to 5 years before his desired payout age of 60 (i.e. 15 years).

|

5 years

|

| Step 2: Choosing Duration Of Monthly Payout

|

Mr Ong then decides the number of years he wants to receive monthly cash payouts, which can be 10, 20 or 30 years.

|

20 years starting from age 60 |

| Step 3: Make Regular Contribution To Retirement

|

Mr Ong will now start to make regular contribution to RevoRetire based on the premium payment that he has chosen in step 1.

|

Mr Ong pays a premium of $26,102 per annum over the next 5 years. Total premium paid: $130,512 |

| Step 4 (Optional): Make Changes To Duration Of Monthly Payout

|

As long as Mr Ong hasn’t started his receiving his payout, RevoRetire gives him the option to change his payout duration. He can also choose not to make any change to his payout duration.

|

No changes made |

| Step 5: Start Receiving Monthly Payout For Retirement

|

Upon reaching his choice of retirement age, Mr Ong will start receiving monthly payouts from Income for the duration chosen in step 2. |

Mr Ong will receive a monthly payout of $1,000 for 20 years, from age 60 to age 80. There will also be a non-guaranteed cash bonus of up to $730 per month. |

4 Features About NTUC Income Gro Retire Ease That Makes You Want To Get One Today For You Retirement

-

NTUC Income Gro Retire Ease Offers Unrivalled Flexibility Among Retirement Plans

Unlike most retirement plans where the features are fixed and inflexible, RevoRetire was designed to let you be in control of your own retirement planning. With RevoRetire, you can easily craft your own desired retirement lifestyle with options that let you decide when you want to retire and how long you would like to receive your monthly cash benefit.

You can even make adjustment to your payout period within 10,20 or 30 years even after your RevoRetire is in force, which is the only retirement plan that lets you do that in Singapore. The only caveat is that you have to do it before your first monthly cash benefit is due.

Flexibility Lets You Adjust Your Monthly Payout Depending On Your Needs, Retirement Savings Amount

With the flexibility, you can readjust your monthly payout depending on whether you have enough retirement savings in place. If there is a shortfall to your retirement savings, you can choose to shorten your payout duration to receive more monthly payout to cover the shortfall. If there is a surplus in your retirement savings, you can choose to lengthen your payout duration and receive monthly payout for a longer period of time (albeit smaller amount).

-

NTUC Income Gro Retire Ease Comes With Early Stage Disability Protection To Give You A Peace Of Mind

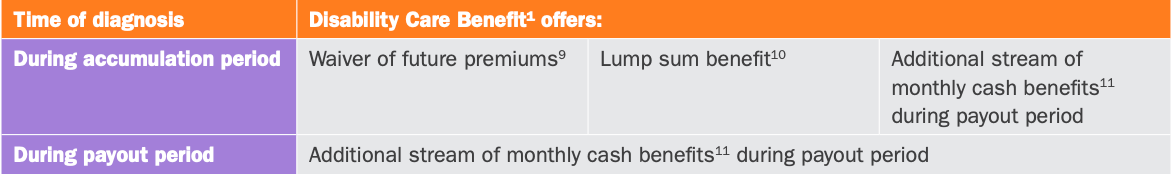

When you kickstart a Retirement plan from NTUC, you will be insured by Income for death and accidental death. Besides that, you will also receive additional disability coverage under Gro Retire Ease Disability Care Benefit. The Disability Care Benefit that Gro Retire Ease offers is the most lenient disability claim in the market in the event of

- loss of use of one limb;

- Loss of speech, hearing, or;

- Loss sight in one eye due to accidental injury or illness.

If you are struck with a disability, not only will your premium liabilities be waived, you will also receive double the guaranteed monthly payout. You will also receive a lump sum benefit equivalent to 6 times the monthly cash benefit.

Source: NTUC Income RevoRetire

-

NTUC Income Gro Retire Ease Comes With Guaranteed Acceptance Regardless Of Your Pre-Existing Conditions

The aim of Gro Retire Ease is to help Singaporeans retire with better retirement planning. Thus, Income has made it such that application for RevoRetire is guaranteed. Regardless whether you have any pre-existing conditions, you will be guaranteed acceptance for Gro Retire Ease. There is no need for medical check-ups. You can be ready for your retirement with just a simple step.

-

NTUC Income Gro Retire Ease Anchors Your Retirement Dream By Growing Your Savings

Perhaps, the most important feature of Gro Retire Ease is the yield that you can receive on your savings to anchor your retirement dream. Sharp-eyed readers would have realized that Mr Ong (our case study protagonist) only paid $130,512 in premiums. However, he eventually receives $240,000 payout from Income over the next 20 years. This is close to double of the $130,512 that he paid in premiums. Not to mention, there is also a non-guaranteed cash bonus that could bring his payout to $415,152.

Source: NTUC Income Gro Retire Ease

Start Planning For Retirement Today With Gro Retire Ease

One small step can really change your life, especially if that small step is to start a retirement savings plan. If you are looking forward to enjoying life after retirement, Gro Retire Ease could be your best plan.

We help you to compare NTUC Income RevoRetire, Manulife RetireReady Plus and Aviva MyRetirement Choice to see which plan suits you best

Send us your enquiry now!

3 Comments