Planning For Retirement in Singapore

Setting goals is the first step in achieving anything that you want. For many of us, retirement is a goal that we all aim for. We start planning for retirement in Singapore so that we can have enough time in our lives for us to enjoy life. However, do you know how much money you need every month to achieve the desired retirement lifestyle you want?

Interestingly, not many of us knows that number. That is quite ironic given that it is a goal that we are aiming for, isn’t it? Well, that’s why we decided to create this guide to help you take the first step towards achieving your retirement goals: To recognize how much money you need every month to retire.

4 Key Things To Consider When Planning For Retirement

To put a number to your retirement, there are a few things that you need to consider.

Choice Of Lifestyle For Retirement

The first is to consider your choice of lifestyle during retirement. The choice of lifestyle is the biggest contributor to the cost of your retirement.

After all, when you are in retirement mode, you are constantly in net-expense mode where you are spending more than you are earning (if any). Thus, your choice of retirement lifestyle will affect how much retirement savings you need.

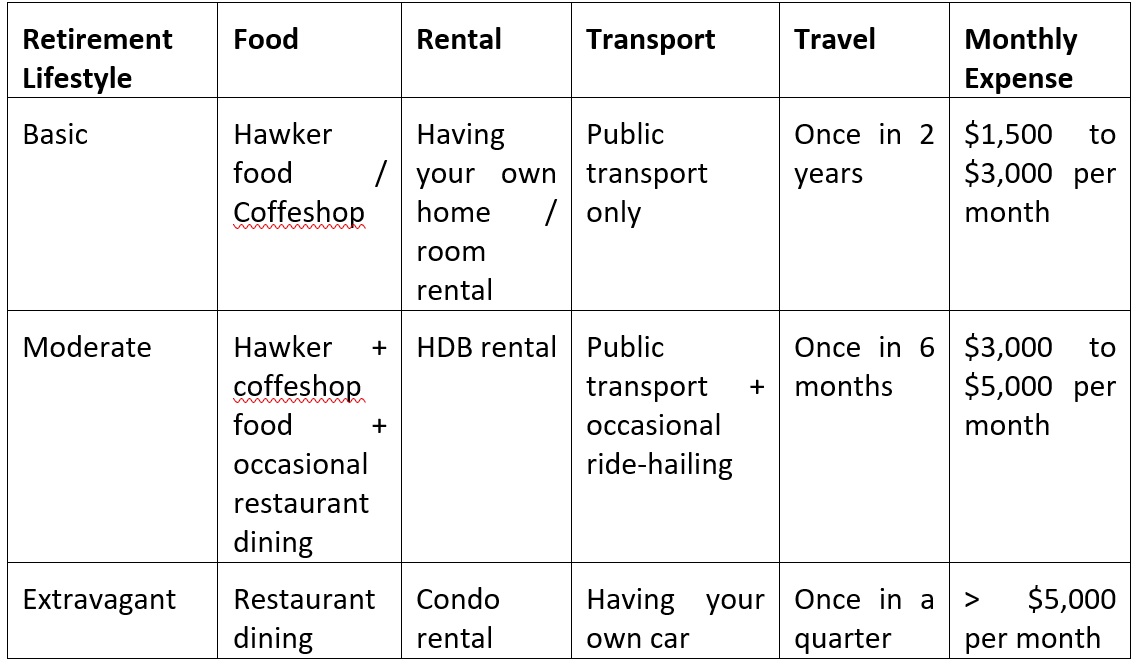

Here’s a simple breakdown of what you can enjoy in each of the retirement lifestyle choices:

The table above is a basic guide to what each of the different retirement lifestyle includes for some of the major areas of expenditure.

There are many different combinations that you can create from this matrix. Depending on what kind of retirement lifestyle you aspire for and how you mix and match the food, rental, transport, and travel, your monthly retirement expense will change.

Do You Have Supplementary Income?

While the definition of retirement is to quit your job and stop working, you don’t have to follow this convention. In fact, there’s no stopping you from working even after you “retire”. You can still continue to take on part-time work during your retirement as long as you are willing and able to do that. It doesn’t mean that you have to stay at home the whole day after you retire.

If you are going to take on some work commitments, then that’s good for your finances because it means that you can offset some of your retirement expenses. However, if you are going to take the meaning of retirement literally, then you need to make sure that you have enough retirement savings for you to retire without worry.

Is Your CPF Life Income Enough?

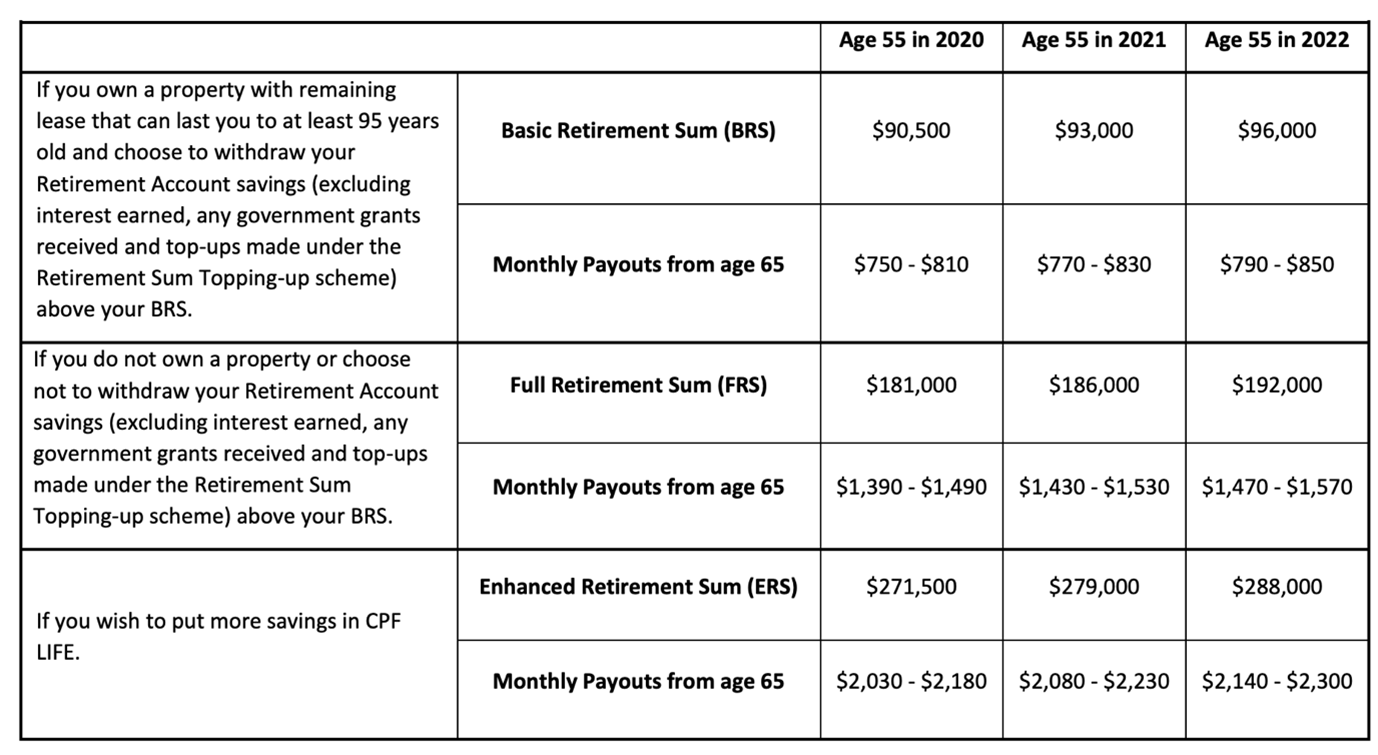

The word “retirement” is often associated with CPF. Many of us have this notion that CPF Life will be there for us to cover our retirement expenses. Well, it depends on what kind of CPF Life plan you chose.

Source: CPF

If you have the Enhanced Retirement Sum (ERS), you can only get around $2,200 per month. That will just be enough to cover the monthly expenses that you have if you are willing to settle for the basic retirement lifestyle. But what if you are looking for a moderate or even extravagant retirement lifestyle? Unfortunately, then you wouldn’t be able to just rely on your CPF Life income.

And for those who only stashed away the Basic Retirement Sum (BRS), you definitely won’t even have enough for your basic retirement lifestyle. Either you cut back on your expenses, or you have to take on some part-time work to supplement your income.

Inflation: Eating Away At Your Purchasing Power

There is another silent killer that is trying to stop you from achieving your retirement goals: Inflation. Every year, inflation is eating away at your purchasing power. Even if you were to save up $1,000,000 in the next 30 years, the effect of inflation (e.g. 1%) means that you will only have around $700,000 “left” for your retirement.

And that’s not the most scary thing. The scariest thing is that many are unaware of the impact that inflation can have on your retirement! Most people forget about inflation when planning for retirement.

In the end, they find that there is a gap between their retirement aspiration and the reality.

Thus, if you are planning for your retirement, make sure that you also account for the impact of inflation. A simple rule of thumb is to take 1% x no. of years you have till your retirement and add that on top of your retirement savings.

For example, if you need to save $1,000,000 in 20 years for your retirement, add this inflation buffer of 20% (20 x 1%) to how much retirement savings you need. Of course, if you want to be conservative, you can even adjust the inflation rate to 2%, rather than 1%.

How Can You Plan Your Retirement Today?

Luckily, the goal towards retirement is a marathon, not a sprint. If you can start your journey early, the more time you have to plan for it, prepare for it, and save for it. Thus, even if you haven’t started putting your retirement aspirations into concrete goals, you can still start today.

And by reading this article and realizing you need to do something about your retirement, you are already ahead of many people. Not just that, you also have us to help you on your journey to achieve your retirement aspirations.

Read: How much do i need to retire in Singapore

Read: 3 Best Retirement Plan in Singapore

4 Comments